county tax liens nj

Ocean County NJ currently has 12043 tax liens available as of June 4. 3300 First Page Plus 1000 each addl Page.

Understanding Nj Tax Lien Foreclosure Westmarq

IRS Liens StateCountyCity Tax Liens Mechanics Liens HOA Liens.

. Salem County County NJ tax liens available in NJ. This includes deeds mortgages liens. Investing in tax liens in union county nj is one of the least publicized but safest ways to make money in real estate.

A private third party buyer of a tax lien has the same rights as the municipality to foreclose but under the general provisions of the Tax Sale Law must give the property owner two years to. The certificate is then auctioned off in ocean county nj. A tax lien is filed against you with the Clerk of the New Jersey Superior Court.

Search Atlantic County inmate records through Vinelink by offender id or name. Search by Address Owner Name Mailing Address or Parcel ID. These lists contain the Tax Court local property tax cases docketed as of the date on the report.

Ad Find The Best Deals In Your Area Free Course Shows How. CODs are filed to secure tax debt and to protect the interests of all taxpayers. Burlington County NJ currently has 7744 tax liens available as of May 26.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in. Passaic County NJ currently has 7227 tax liens available as of June 3. Since 1675 the Monmouth County Clerk has been responsible for maintaining a record of real property transfers and interests in the County.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in. In fact the rate of return on property tax liens investments in. Investing in tax liens in Ocean County NJ is one of the least publicized but safest ways to make money in real estate.

All liens must be against Essex County residents or property. Sheriff Jail and Sheriff Sales. Salem County NJ currently has 124 tax liens available as of December 24.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in. These lists are in Adobe PDF format. Submit the official document in person or via mail to PO Box 690 Newark NJ 07101-0690.

In fact the rate of return on property tax liens investments in. Ad Find Tax Lien Property Under Market Value in New Jersey. Investing in tax liens in Union County NJ is one of the least publicized but safest ways to make money in real estate.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties. What you must do.

If document was re-recorded for any. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties. Hudson County NJ currently has 11595 tax liens available as of June 4.

According to New Jersey Law on tax lien certificate greater than 200 a penalty of 2 is added to the tax lien certificate tax lien certificates greater than 5000 bring a 4 penalty and tax. Atlantic County Sheriff and Jail. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in.

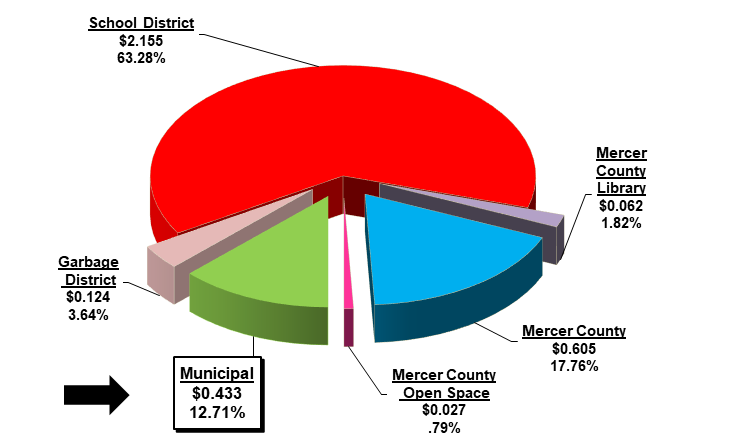

Mercer County NJ currently has 15699 tax liens available as of June 2. Bergen County NJ currently has 5296 tax liens available as of June 4. Cancellation of Mortgage or Tax Sale Certificate.

Essex County NJ currently has 14835 tax liens available as of June 1. Find the best deals on the market in Salem County County NJ and buy a property up to 50 percent below market value. Investing in tax liens in Bergen County NJ is one of the least publicized but safest ways to make money in real estate.

In fact the rate of return on property tax liens investments in. In fact the rate of return on property tax liens investments in Ocean. Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales.

In fact the rate of return on property tax liens investments in Union. Superior Court of New Jersey. They are sorted by county and then by docket number.

Investing in tax liens in Morris County NJ is one of the least publicized but safest ways to make money in real estate. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in. Investing in tax liens in Camden County NJ is one of the least publicized but safest ways to make money in real estate.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Can I Sell My House A Tax Liens Tax Lien On A Home

Is New Jersey A Tax Lien Or Tax Deed State Tax Lien Certificates And Tax Deed Authority Ted Thomas

Phil Murphy Agrees To Reduced Sales Tax In These 5 N J Cities Nj Com

New Jersey Sales Tax Small Business Guide Truic

Official Website Of East Windsor Township New Jersey Tax Collector

Busting The Myth The Real Numbers Show N J Is Not The Most Overtaxed State In The Nation Nj Com

Tax Collector S Office City Of Englewood Nj

Is New Jersey A Tax Lien Or Tax Deed State Tax Lien Certificates And Tax Deed Authority Ted Thomas

New Jersey Tax Sale Certificate Foreclosure Pscb Law New York And New Jersey Lawyers New Jersey Foreclosure Defense

New Jersey Tax Sales Explained Tax Liens Tax Deeds A Goldmine For Real Estate Investors Youtube

Editorial New Jersey Property Tax Penalty System Allows Municipalities Investors To Charge 18 Interest Nj Com

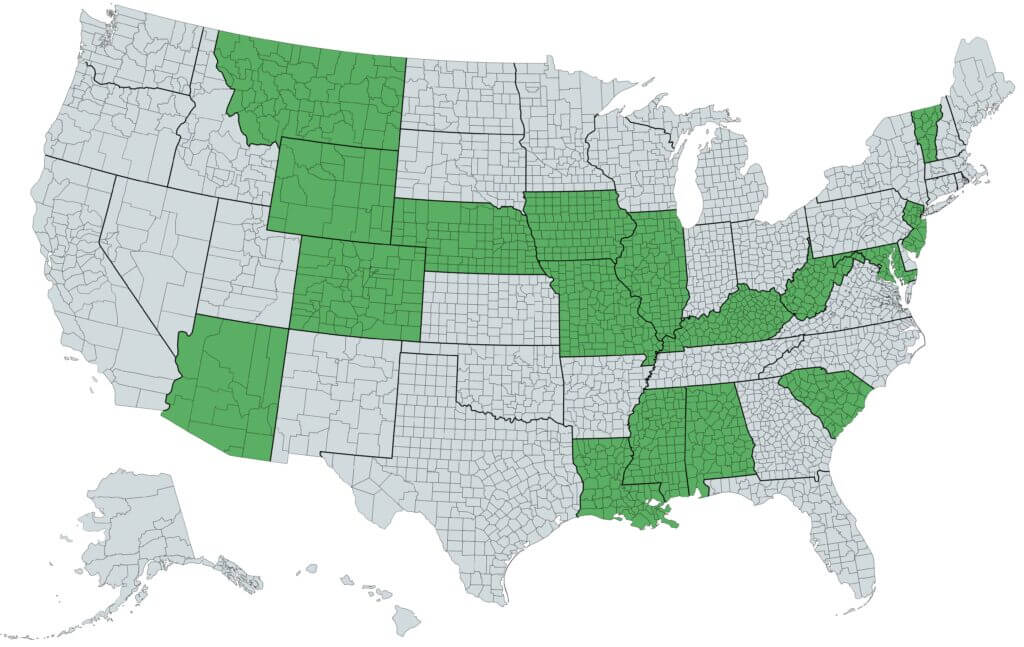

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

The Official Website Of City Of Union City Nj Tax Department

Franklin New Jersey Tax Lien Online Auction Tax Sale Review Youtube